The telecommunications industry is experiencing tremendous growth, which introduces new opportunities for companies to receive higher valuations.

However, uncertainty related to new technology, state and federal regulatory updates, and customer behavior have the potential to affect a telecommunications company’s business valuation.

Below, gain insight into valuation approaches, related industry trends, and factors to consider when planning your company’s business valuation.

Business Valuations Approaches for Telecommunications Companies

Telecommunications carriers are generally classified in one or several of the following categories:

- Wireless technology

- Voice over internet protocol (VoIP)

- Internet service provider (ISP)

- Mobile phone and wireless carrier

- Competitive local exchange carriers (CLEC)

- Local exchange carriers (LEC)

- Satellite communications

When assessing telecommunications carriers, valuation professionals generally analyze the following three approaches, and then determine value based on one or more method.

- Income approach, or discounted future cash-flow analysis

- Market comparable approach, which analyzes publicly traded companies or mergers and acquisitions

- Asset-based approach, which is the value of the company’s assets, less its liabilities

While these approaches all apply to telecommunications valuations, they often require adjustments to reflect a company’s location, services, size, growth, profitability, capital structure, and other characteristics.

Here’s an in-depth look at each technique.

Income Approach

Many business valuation professionals put heavy emphasis on the income approach, which looks at a company’s future cash-flow potential and discounts that future cash flow to a present value.

Revenue, expense, and capital-expenditure projections over a longer period are important considerations for this approach. They help set the income and cash flow expectations of the company, while a company’s services, profits or losses, size, customer base, and other unique characteristics determine the return rate.

Factors That Impact Revenue

Revenue for telecommunications providers can be highly dependent on regulatory sources, such as Universal Service Fund or broadband deployment grants.

Throughout the COVID-19 pandemic, many companies have continued to benefit from federal regulatory reforms implemented over the last five years, including:

- The Alternative Connect America Cost Model (ACAM)

- Connect America Fund Phase II (CAF II)

- Rural Digital Opportunity Fund (RDOF) funding

- Enhanced ACAM support

These programs provide funds to recipients in exchange for meeting defined broadband deployment obligations.

The pandemic also increased the need for upgraded and faster broadband services, especially to residential customers, which resulted in increased broadband revenues. These revenue spikes can positively impact a company’s income analysis as well as its valuation.

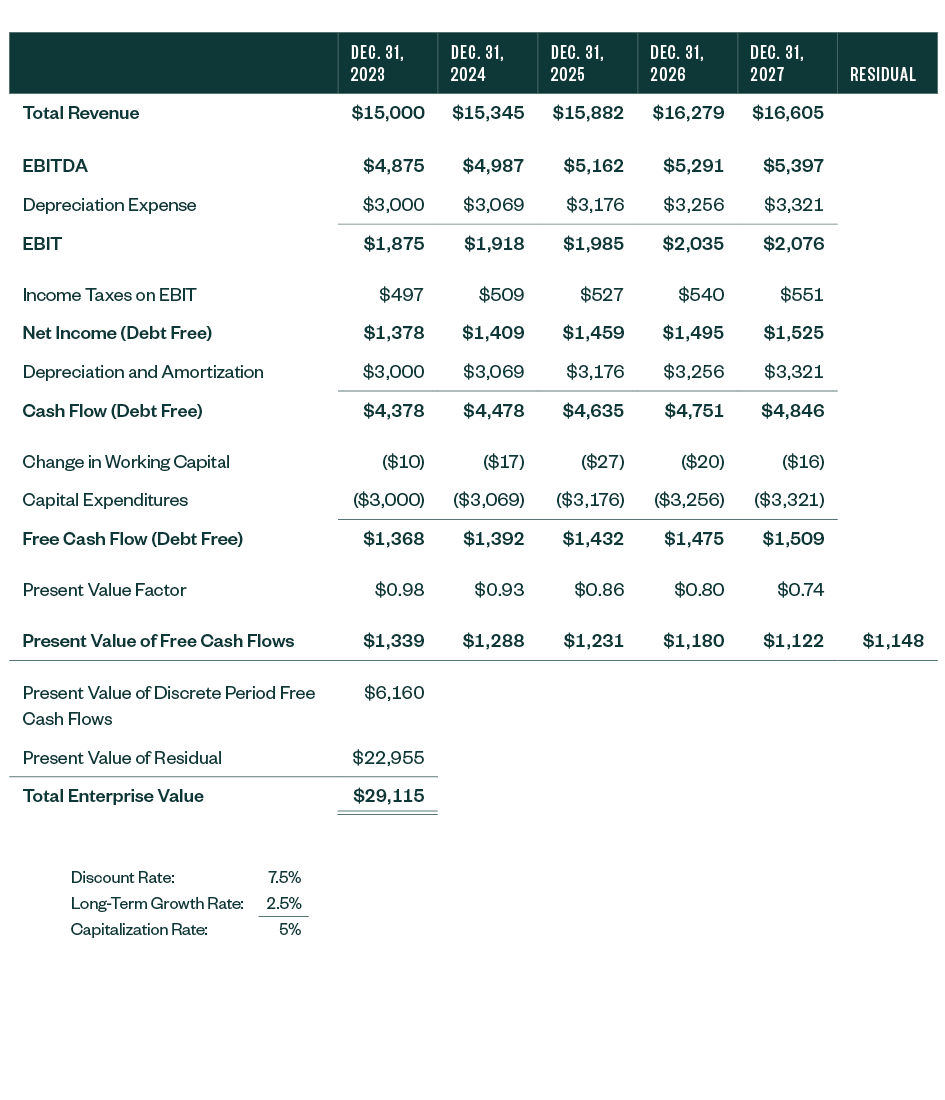

Sample Income Approach Analysis

The below table reflects key factors a business valuation professional evaluates in an income approach valuation.

Market Comparable Approach

The market comparable approach applies multiples from public companies and reported mergers and acquisitions (M&A) to a company’s actual income and cash flows.

This approach is often viewed as a measure of support for the value determined in the income approach.

Comparability in the market approach is always an important consideration, where a company’s characteristics, such as size and diversified product offerings, can make companies and transactions even less comparable.

However, participants in the industry often use market multiples as their own valuation assessments. Multiples from publicly traded companies are easy to find and derive. Publicly traded companies report quarterly results and daily stock prices, and market analysts follow and report on larger companies.

Stock prices for public companies tend to move quickly as market analysts rapidly communicate future expectations, as well as current results, to the marketplace. These amounts are then reflected in industry multiples, which can vary depending on the types of services a company provides.

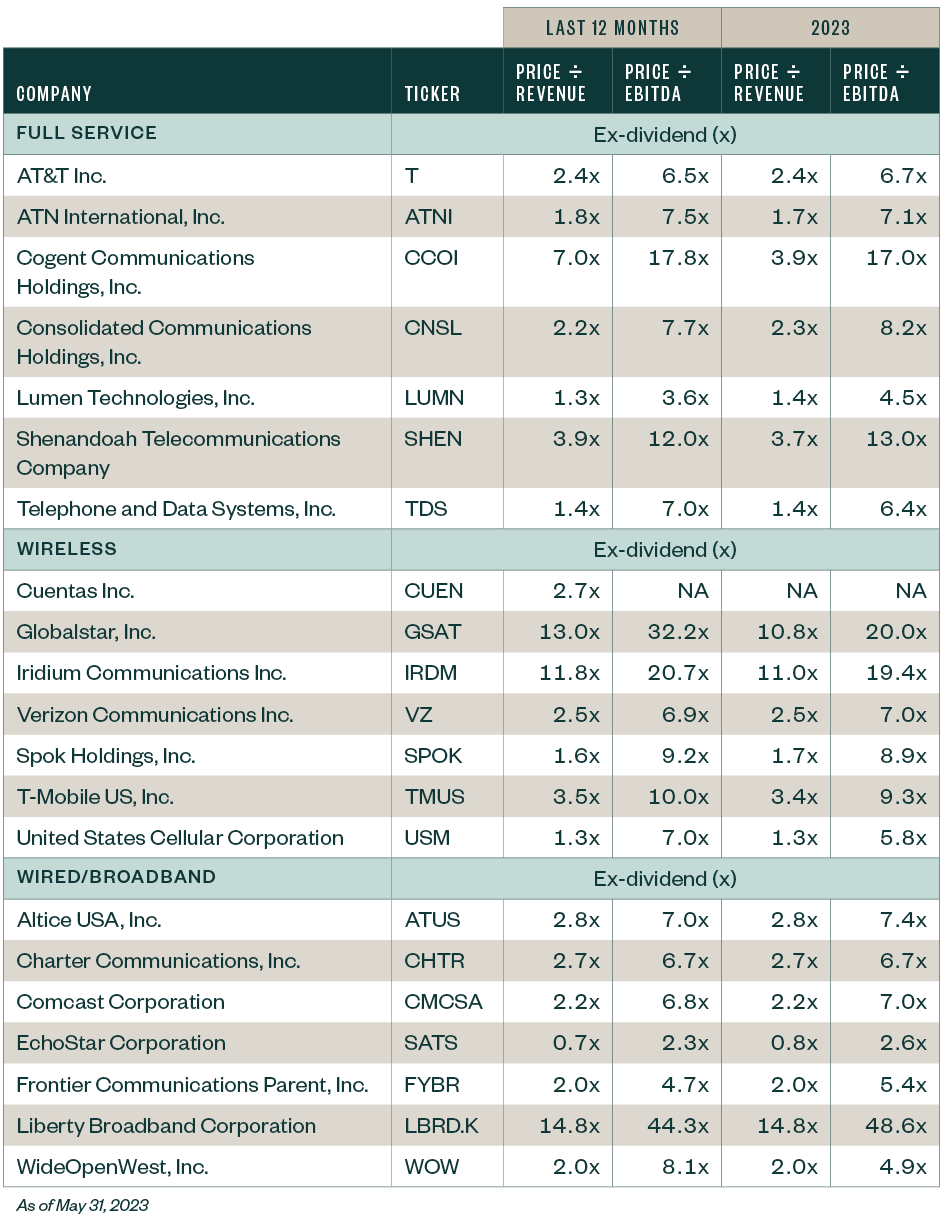

Sample Market Comparable Values

The below table reflects the trading multiples of several companies in the telecommunications industry. These are often used as a starting point for valuation professionals in determining an appropriate multiple to use in the valuation of a specific company.

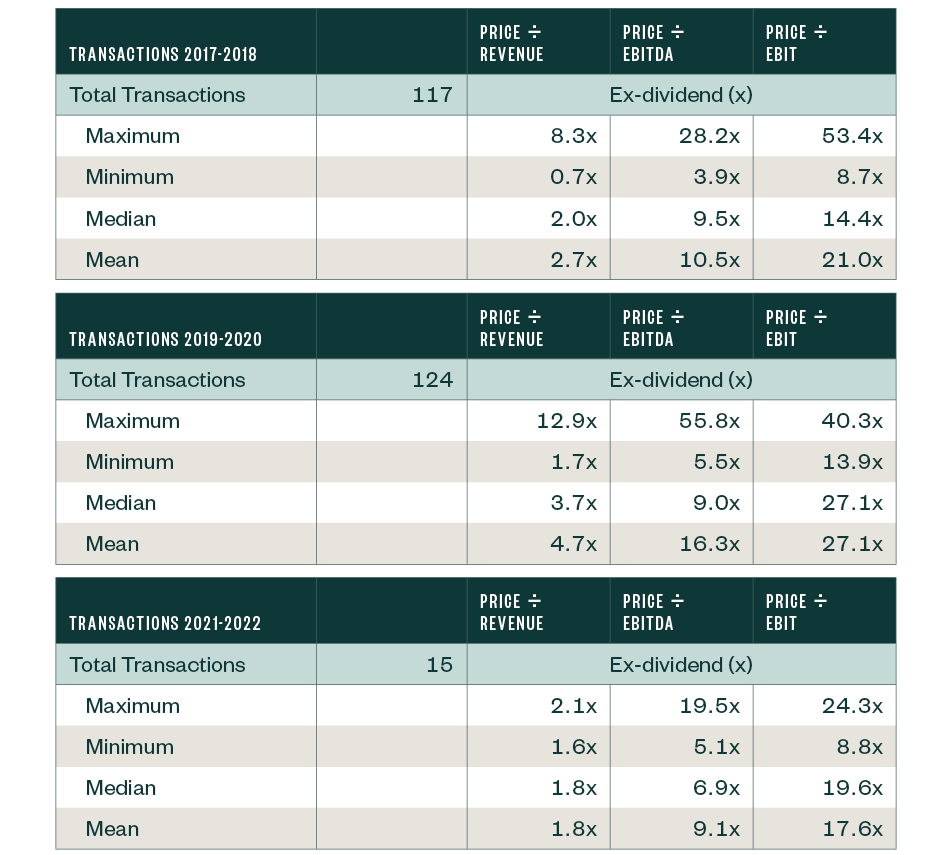

In the market approach, data from acquired companies can also provide market multiples to assist in the valuation process. Acquisition data should be examined carefully; economic and industry characteristics and changes are important factors in acquisition timing.

Acquisitions that occur during a growing period or service expansion when future expectations are high may overstate what investors are willing to pay, and vice versa.

Recent Acquisition Multiples

Asset-Based Approach

The asset-based approach is often seen as a measure of last resort.

It effectively reports the value of the company’s assets less its liabilities, but it can’t identify and value assets that aren’t on a balance sheet, such as tradenames, customer relationships, and goodwill.

Business valuations professionals often abide by the following process in this approach:

- Making adjustments to the company’s historic balance sheet on an asset-by-asset basis

- Reviewing cash, which may be the only asset that doesn’t require an adjustment to determine its market value

- Reviewing and adjusting receivables for defaulted or doubtful accounts that have a low probability of being repaid

In the telecommunications industry, the level of fixed assets can be substantial because telecommunications companies must continually make investments in their networks to keep up with changing technologies and demand for services. On the liability side of the balance sheet, debt and other long-term obligations can reduce the amount of equity available.

These factors make this approach challenging for many companies because it often only captures the historical costs associated with the company’s balance sheet.

Considerations When Choosing Your Approach

Deciding on the right valuation approach will largely depend on your company’s facts and circumstances.

Before making your decision, it’s important to review the following to get the most out of your valuation:

- Profitability and Cash Flow Changes. Do historic results represent future expectations, or will the company benefit from higher income and cash flow in the future? Changes to profit and cash flow can make the income approach more effective for your company.

- Marketplace considerations. Poor marketplace conditions can make the income and market-based approaches less impactful.

- Your service offerings. Your services impact your company’s revenue, which can make the income approach more or less effective for your company.

- Industry changes and customer demand. Regulatory, technology, and service changes can affect the relevance and comparability of any of the valuation approaches.

- Comparability. How comparable is you company in terms of products and services to the publicly traded or acquired companies? This can determine whether the market-based approach makes sense for your company.

If your company has many changes and new programs that generate revenue, the income approach may paint the best picture of your company’s future income and cash flow.

However, in segments, like fiber to the home and fiber transport, customer demand is making market multiples more prevalent. This means the asset-based approach will also continue to be important given industry changes and heavy plant investments required.

Industry Trends that Could Impact Business Valuation Services

Service providers often offer different services and programs based on consumer demands, which can impact their company’s value. Here are some key trends that could affect your business valuation.

Technology Developments

Carriers constantly look for new and more efficient technologies that enable customers to communicate through voice, video, or a data medium of their choice. These technologies include everything from traditional copper and fiber-based wireline services to fixed, mobile, and satellite-based wireless services.

Wireline technologies continue to expand the speed and capacity services providers can deliver. At the same time, wireless technologies are among the fastest-growing segments in the industry and continue to create faster connections to meet customer demand.

As customer behaviors around these technologies change, service providers will need to continue shifting their services and programs to meet demand.

At the same time, technology advancements and their impact on a company could increase value by providing more income and cash flow.

Compliance Regulations

As the industry continues to grow, telecommunications companies must be aware of risks introduced by changing government regulations.

While these changes can protect incumbents through creating barriers to entry and providing universal service funding, they can also create uncertainty by making it harder for companies to stay compliant with reporting requirements.

For example, Enhanced ACAM funding provides certainty in universal service funding for a 15 year period, while ACAM I and II and Legacy Rate-of-Return support mechanisms currently have shorter funding horizons and greater long-term uncertainty. However, these provisions also come with significant broadband deployment obligations that might not be accurate based on today’s broadband serviceable locations and broadband availability data—for both incumbents and competitors alike—and might bring uncertainty at the end of 2025 for Enhanced ACAM carriers and at the end of the funding periods for all carriers.

Additionally, the certainty in universal service funding may add to a company’s value, but that value needs to be adjusted to reflect the future risks associated with meeting—or not meeting—deployment obligations and the potential elimination of support.

These regulations can have positive and negative impacts on the value of a company. Although they may provide protection to an existing company, they could also hamper a company’s ability to add services or features.

We’re Here to Help

Receiving a valuation is an important stage of your company’s life cycle. To learn more about valuation strategies and which approach is right for your business, contact your Moss Adams professional.